White Economic Advantage + Black Economic Suppression = Modern Vectors of Economic Racism

"For the (racial wealth) gap to be closed, America must undergo a vast social transformation produced by the adoption of bold national policies, policies that will forge a way forward by addressing, finally, the long-standing consequences of slavery, the Jim Crow years that followed, and ongoing racism and discrimination that exist in our society today."

W. Darity, D. Hamilton, M. Paul, A Aja, A. Price, A. Moore, and C. Chiopris

Learn about each modern vector of economic racism below:

Reckoning with an Unjust Past: a Spoken Word Series by Veronica Wylie

Summary

"New York Life, the nation’s third-largest life insurance company, opened in Manhattan’s financial district in the spring of 1845. The firm possessed a prime address — 58 Wall Street — and a board of trustees populated by some of the city’s wealthiest merchants, bankers and railroad magnates.

Sales were sluggish that year. So the company looked south.

There, in Richmond, Va., an enterprising New York Life agent sold more than 30 policies in a single day in February 1846. Soon, advertisements began appearing in newspapers from Wilmington, N.C., to Louisville as the New York-based company encouraged Southerners to buy insurance to protect their most precious commodity: their slaves.

Alive, slaves were among a white man’s most prized assets. Dead, they were considered virtually worthless. Life insurance changed that calculus, allowing slave owners to recoup three-quarters of a slave’s value in the event of an untimely death.

James De Peyster Ogden, New York Life’s first president, would later describe the American system of human bondage as “evil.” But by 1847, insurance policies on slaves accounted for a third of the policies in a firm that would become one of the nation’s Fortune 100 companies."

Rachel L. Swarns

Insurance Policies on Slaves: New York Life’s Complicated Past - The New York Times (nytimes.com)

Modern insurance practices demonstrate considerable disparities in the treatment of Black vs white customers. State Farm is facing lawsuits from customers, agents and former employees accursing it of racial discrimination.

"It took years for Darryl Williams to build up the small real estate portfolio that became Connectors Realty, his business on the South Side of Chicago. In early 2017, when a pipe burst in his prized property — a building containing six apartments — Mr. Williams turned to his insurer, State Farm, to help repair the damage.

Mr. Williams said a State Farm claims adjuster told him that she did not believe his version of events. “We have a lot of fraud in your area,” he said the adjuster had told him. Like the majority of people in his neighborhood, Mr. Williams, 58, is Black.

State Farm eventually paid Mr. Williams a small fraction of his claim. By then, his expenses had snowballed. He sold his buildings to pay his bills...."

Quotes

That racial bias was built into these (burial) policies was long an open secret in the insurance industry. Insurance forms asked the applicant’s race, and black were routinely charged more than whites for the same coverage, the insurance industry now publicly acknowledges.

Typically, it was one third more, according to lawyers representing black policy holders.

Throughout the 20th century, an occasional government report, lawsuit, or news article questioned the morality or legality of this practice, but until recently there were no organized challenges.

For decades, the insurance industry defended the discriminatory practice, arguing that blacks on average didn’t live as long as whites, making them a worse insurance risk.

“At that point, discrimination was considered an actuarial science,” says Joanne Stone Morrissey, president of the insurance researcher Firemark Group in Morristown, N.J.

However, attorneys for black policyholders say, many insurers continued the practice long after it became known that it was poverty, poor medical care and risky jobs — not race — that contributed to shorter life spans. That meant blacks continued to pay more than whites who faced similar risks. Insurance industry facing lawsuits, restitution (nbcnews.com)

Personal Narratives

“Even though plantation slaves were valuable in the marketplace, they were never insured,” Ralph said. “They were viewed more as livestock. They enhanced the value of the plantation but their skills weren’t seen as valuable or premium.” Instead, slave owners would insure coal miners, Blacksmiths, carpenters, railroad workers and other slaves with valued skills. Miners, for example, made up 15.4 percent of the insured slave workforce, according to the project. Steamboat workers accounted for 12.6 percent of those insured and domestic workers accounted for 14.6 percent of the insured slave population, according to the ledger.”

New York University Professor Michael Ralph

Visualizing the slave insurance industry.

*****************

In 2005, JP Morgan Chase conceded that two of its subsidiaries Citizens' Bank and Canal Bank in Louisiana accepted enslaved people as collateral for loans.

Historical analysis conducted for J.P. Morgan by History Associates Inc. of Rockville found that between 1831 and 1865 the two banks accepted approximately 13,000 slaves as collateral and ended up owning about 1,250 slaves.

*****************

On September 30, 2000, Governor Gray Davis of California signed two bills relating to slave insurance. One bill was written by former California State Senator Tom Hayden.[3] The California legislature found that:

Insurance policies from the slavery era have been discovered in the archives of several insurance companies, documenting insurance coverage for slaveholders for damage to or death of their slaves, issued by a predecessor insurance firm. These documents provide the first evidence of ill-gotten profits from slavery, which profits in part capitalized insurers whose successors remain in existence today.[4]

Methods of Discrimination

Insurance policies on slave-trading ships

Beginning in the 18th century, maritime insurance for the slave-trade became a lucrative revenue source for British insurance companies

Insurance on highly skilled individual slaves

By the mid-1840s American insurance companies were providing insurance covering a highly skilled class of African slaves, while enslaved plantation workers were rarely covered.

Refusal to insure mortgages and homes in redlined areas

Despite wide availability of mortgages and a new ability for lower middle-class people to buy homes, African Americans are blocked from doing so, due to refusal from insurance providers to cover their home purchases.

Charging African Americans more for auto, homeowner insurance and life insurance

Regardless of credit-rating, African Americans are charged more for all types of insurance.

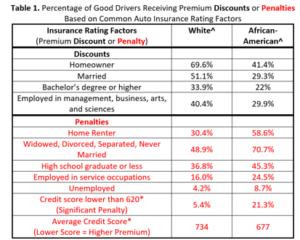

“African-Americans are disproportionately represented in the higher premium categories, as Table 1 illustrates, which leads to higher prices for the exact same coverage, even before considering geographic pricing disparities. CFA found, in a 2015 report, that ZIP codes with predominantly African American residents face premiums that are 60% higher than predominantly white ZIP codes, after adjusting for population density. Taken all together, it is clear that African Americans will pay more for auto insurance than white drivers, even when everything related to driving safety and vehicle type is held constant.” [5]

Accusing African Americans of fraud with regard to claims; not honoring claims.

Timelines of Disparity

1790s

Historians have estimated that the slave and West India trades combined accounted for 41% of British marine insurance in the 1790s.

1860

Aetna, AIG and New York Life Insurance become the primary insurers of the slave trade in the U.S.

https://techcrunch.com/2018/02/22/visualizing-the-slave-insurance-industry/?guccounter=1

1920s

In the 1920s and 1930s racial and ethnic minorities were assumed to be bad risks for insurance. A 1933 report concluded that screening based on risk should not be performed by the name, but by further investigation into racial or ethnic backgrounds.

https://www.insurancejournal.com/news/international/2020/06/19/572859.htm

Metrics

“African-Americans are disproportionately represented in the higher premium categories, as Table 1 illustrates, which leads to higher prices for the exact same coverage, even before considering geographic pricing disparities. CFA found, in a 2015 report, that ZIP codes with predominantly African American residents face premiums that are 60% higher than predominantly white ZIP codes, after adjusting for population density. Taken all together, it is clear that African Americans will pay more for auto insurance than white drivers, even when everything related to driving safety and vehicle type is held constant.” [5]

Websites

Articles

[1] Visualizing the slave insurance industry (M. Dickey)

[5]Systemic Racism in Auto Insurance Exists and Must Be Addressed By Insurance Commissioners and Lawmakers

[6] Some Facts About London’s Role in Insuring the Slave Trade (G. Faulconbridge)

[8] The Racist Housing Policy That Made Your Neighborhood (A. Madrigal)

[9] Ending Jim Crow Life Insurance Rates (M. L. Heen)

[9] The Treasury of Weary Souls - insurance policy records for enslaved Africans

Slave insurance in the United States - Wikipedia

Insurance Policies on Slaves: New York Life’s Complicated Past (R. Swarns)

Insuring the Transatlantic Slave Trade | The Journal of Economic History | Cambridge Core

Decoder: The Slave Insurance Market – Foreign Policy

The Price of Life: From Slavery to Corporate Life Insurance | Dissent Magazine

Where State Farm Sees ‘a Lot of Fraud,’ Black Customers See Discrimination

Books

The White Wall: How Big Finance Bankrupts Black America by Emily Flitter

Investing in Life: Insurance in Antebellum America by Sharon Ann Murphy

Podcasts

The Assets | Uncivil (gimletmedia.com) - Rachel Swarns on slavery and the insurance trade

Film/Video

Underwriting Souls (youtube.com)

How Banks Made Money From Slavery | Empires of Dirt - YouTube

Questions for Research and Reflection:

Which myths based in white supremacy culture did you grow up with?

- Anyone can get mortgage insurance; you just need good credit

- Policies and rates are the same for everyone

- Why don't "they" just read the small print? Can't we all spot a bad deal?

Ask a Black colleague or research on your own:

- Did family members have problems obtaining insurance of any type from the 1930s – 1980s?

- Were any family members sold fraudulent insurance policies, such as those during the Jim Crow era that purported to cover funeral costs?

- When did you learn about life insurance and or renter's insurance? Who introduced you to these concepts? Could you easily afford policies?

- How might differences in access to resources affect net worth over generations?